What is Finance and Investing?

Investing is the process of using capital to acquire an asset that will appreciate in value over time. This can take many forms, but it is most commonly associated with purchasing stocks and bonds, and investing is an important skill to learn if you hope to make your money work for you. Learning how to invest can help teens and young adults build financial independence and help them make larger purchases (like cars or houses) when the time comes for them to do so. This extra bit of security and money can go a long way towards helping young adults prepare for their future and build a rainy day fund (and a nest egg).

Additionally, learning investing involves learning how to keep financial records and organize your portfolio and investment plans. Keeping good records of your financial situation and the ways in which you are spending money is an important skill if you want to ensure that your finances remain stable and you neither over-extend yourself or leave capital laying around doing nothing. This record keeping may seem boring, but it is fairly important and there are a lot of newly developed tools and applications that make the process significantly more streamlined and give you access to even more detailed features, such as alerts and up to the minute financial information.

Investing has become even more complex in recent years as retail stock investing has become significantly more common and more and more start-ups are vying for the limited funds available from investors. Unlike decades prior, you can buy and sell assets instantaneously from your phone, so if you feel like trading stocks while on the bus to a friend’s house, you can reasonably do this. This also means you need to be even more aware of the risks and long-term investing strategies if you hope to be successful. It is vital, if you learn to invest, to treat it like an important part of your financial future and well-being, not a sports gambling app.

Why Learn Finance and Investing?

The most obvious reason to learn finance and investing is to make money, since the goal of any investment is to have it appreciate in value over the long-term. This can help you become financially stable and it can help you take your capital earnings and invest those earnings in other investment opportunities. It is also a way to ensure that you have money in the event of an emergency, which is something that worries most young adults just starting out. Learning finance and investing is a good way to give yourself peace of mind, especially if you are engaging in low-risk investment strategies.

In addition to making your life easier and more financially stable, learning to invest your money wisely can help you build the necessary capital for long-term projects and purchases. For example, if you are looking to start a new business, it is likely that you won’t have the necessary capital from the get-go, so you can either rely on a bank (and be subject to things like shifting interest rates) or you can build up the necessary capital through investments and other assets. This also has the advantage of letting you avoid putting all of your eggs in one basket, so you won’t suffer too greatly if one investment project doesn’t pan out.

Learning financing and investment strategies can also open the door to a wide range of different future career paths. Billions of dollars change hands every year in the financial sector and if you live in a city like New York City, you know just how lucrative it can be to work on wall street or at a hedge fund. If you have aspirations of embracing your inner Gordon Gekko, you’ll need to learn the ins-and-outs of investment as an industry, since you can’t succeed in the marketplace on vibes alone. Getting started early in the process will help you learn the necessary skills and technologies that underscore contemporary investing strategies. In addition, you’ll learn how to work with customers and clients, since most professional brokers work as intermediaries for other investment ventures.

What Will you Learn in a Finance and Investing Summer Program

In a summer investing course, the first thing you’ll learn are the basics of investing, including the process of acquiring assets, the different kinds of assets available to you and the pros and cons of investing in major assets. For example, you’ll learn how to buy stocks and bonds since those are the two most common kinds of assets for new investors. Stocks are slightly more volatile than bonds, which have lower returns on investments (in most cases). In addition to stocks and bonds, you may learn about assets like mutual funds (very safe for long-term investments), real estate (very good investments with very high initial capital requirements), gold and other precious metals (stable long-term, very volatile short-term), and even collectables (tough to predict the long-term value but more enjoyable for many).

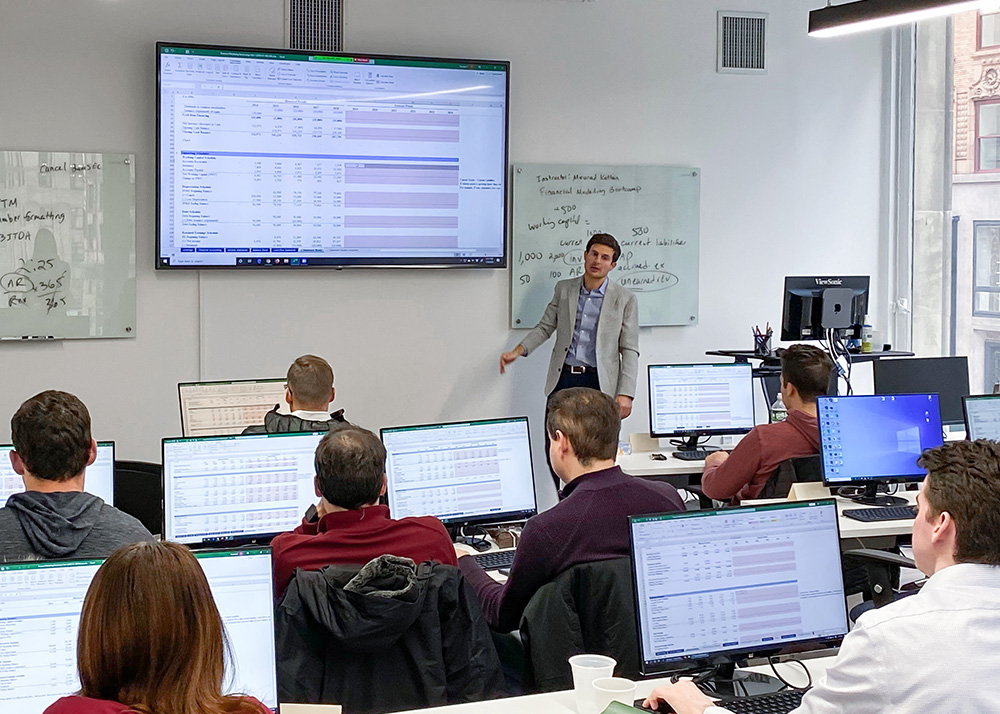

After you are comfortable with the different kinds of investment options available to you, you’ll start to learn how to use applications like Microsoft Excel to create a database to organize your portfolio. While, in the past, you would have physical certificates signaling your ownership of an asset, today that is all handled digitally, so you need to keep accurate records of your assets in order to ensure that you have an accurate understanding of your money situation. This is also a useful skill for building a home budget, a savings plan or other financial regimen, and Excel can be used to interconnect multiple spreadsheets with live updating information.

More advanced finance classes, as well as those focused on future job training, will also likely teach students how to utilize more complex FinTech applications. While the fluctuations of the market are less impactful for retail investors, professionals need to gather, organize and analyze as much data as they possibly can in order to make short-term and long-term decisions about their and their clients’ investments. This includes learning the basics of data analysis programming languages like Python, tools for tracking and evaluating market asset values and data visualization applications like Tableau. This training will help to ensure that you are prepared to use all of the tools at your disposal to ensure that you are making smart and informed decisions.

Finally, you’ll learn a lot about planning and risk management in a finance and investing course. Making money as an investor is about more than just being in the right place at the right time and getting lucky (you can’t really be taught how to buy shares of Apple at 11 cents each). You’ll need to learn how to assess the value of an asset, understand how much it is poised to appreciate in value and what the long-term and short-term risks of that asset entail. This will vary from student to student, but you’ll need to gauge your own level of risk aversion and your short and long-term tolerance for volatility. You’ll also need to learn how to make smart decisions about when to buy and when to sell on your assets, since you don’t want to find yourself holding the bag on a bad stock or too quickly liquidating a valuable asset.

What Can you do with Finance and Investing Training

Most obviously, you can use this training to invest in your future and start making money with the benefits of your initial start-up capital. Learning to invest will be important if you are hoping to retire with a comfortable amount of money, start a business or make a large purchase and starting early is vital to your long-term success. These lessons will help ensure that you are aware of the different styles of investment strategies and the different purposes behind those strategies, so that you can make the best decisions tailored to achieving your personal goals.

For example, if you are looking to start saving for retirement early, you can learn strategies for taking advantage of compound interest and stable, year-over-year gains. If you are looking to build short-term capital to help supplement a big project, you’ll learn how to take the necessary risks to give yourself the best chance at reaching your goals. An investment strategy that pays dividends for one goal may not be well-suited for another goal. You can also start managing large portfolios of diversified assets, which can both improve your long-term earning potential and can help you achieve multiple goals at once (while also giving you more liquidity in your investment portfolio.

You’ll also start the training that you need to pursue a career in finance. Most colleges offer business majors and economic majors for students looking to enter careers in finance and, with the proper training, you can even start working right out of high school. These positions are fairly lucrative, with Investment Bankers earning about $85,000 a year and Private Equity Associates earning as much as $140,000 a year on average. Learning the art of investing can help you start a lucrative career (and use the earnings from that career to continue investing).

Advantages of a Finance and Investing Summer Program

Many students leave high school feeling that they weren’t taught many of the practical skills that they feel they need in order to live on their own. A finance and investing summer program can help with this worry by offering students practical lessons in skills whose real-world applications are immediately visible and relevant. In these classes, students will learn how to keep personal records of their finances, save money and make sound investment decisions to assist in their future financial stability.

In addition, learning these skills in a summer program will allow students to focus on their short-term and long-term goals as they receive personalized support and assistance from their instructors. Unlike in a regular classroom setting, where large class sizes and broad curriculum can make it difficult for students to receive personalized support and guidance on all of the issues that are giving you difficulties. PLus, since there are so many different kinds of financing and investing classes, you can more easily find a course that fits your needs. Some programs are more focused on teaching practical skills, emphasizing basic techniques for safe long-term investing, perfect for students who just want to start building their nest egg. Other programs are designed for students who want to get career-focused training in investment techniques and strategies.

Best Finance and Investing Summer Programs for High School Students

NextGen Bootcamp offers an Excel, Finance, & Investing Summer Program that provides students with detailed instructions on how to manage their financial records and how to invest their money. In this class, students will learn the basics of using Microsoft Excel to track their own financial records, budget their funds, and create detailed and accurate spreadsheets tracking their financial history. This will help ensure that students have a big-picture view of their financial situation, which is the most important first step in setting and achieving long-term financial goals. This training can be helpful for students of any level, and no matter what path a student chooses to follow, this training will help ensure that they can remain financially stable and independent.

Once students are comfortable tracking their financial records, they will be taught how to start investing their extra money in stocks, bonds, and other assets. Long-term investment success is about understanding how to generate consistent returns on investment in your assets, and that requires investors to have a firm understanding of how markets operate and how businesses and their assets are valued. Students will learn how to read publicly available financial statements from businesses to understand whether or not that business is worth investing in, and they will learn how to invest in their future strategically. Students will also learn the advantages and disadvantages of various investment strategies since investing in stock options differs from investing in government-backed bonds. Knowing how these investment options differ is vital to establishing a diverse, risk-averse portfolio.

NextGen Bootcamp also offers a more advanced FinTech Summer Program that teaches students how to program and use software applications that assist in tracking financial data. Successful investing isn’t about hitting big once, it is about making many small, informed decisions that generate reliable, stable returns on investment. In this class, students will learn how to identify a good long-term investment decision and the basics of using computer software to streamline and improve their investment decisions and strategies. At the beginning of the course, students will learn how to use Excel to build financial datasets, including data that track their own personal finances. Then, they will learn how to read financial reports and include that data in their investment strategies.

Once students are comfortable with reading and interpreting financial statements and reports, they will learn the fundamentals of programming software applications using Python and apply these applications to financial modeling. Students will learn how to wrangle and organize data and use conditional Python statements to reveal trends in this data that would be otherwise invisible. Finally, they will learn how to use Python to create charts and graphs that visualize this data and make it easier to understand the implications of their financial analyses. This course will also introduce students to the basics of Python machine learning algorithms which can be used to model more complex financial data and make more informed decisions based on those models.

Many colleges and universities offer summer programs for students looking to prepare themselves for success in higher education. For example, Columbia University offers an Introduction to Finance and Investment Management program that teaches students how to plan and manage investment strategies across diverse portfolios. Students will work with real-world case studies of historically significant companies and learn how to read financial statements and other important publicly available financial records. This course is an ideal introduction to micro and macroeconomic principles, making it a good place to start learning if you are an aspiring econ or business major.

This course aims to provide students with practical advice on building and diversifying their investment portfolios. As with almost all reputable investment classes, students will learn how to make informed investment decisions based on history, theory, and data analysis. At the end of the course, students will work on a project to build and design their own investment strategy and portfolio, providing them with hands-on experience in applying the skill they have learned. The course is taught by experienced investment professionals with years of combined experience in the private investment sector and as instructors at the Columbia University business school.

Fordham University offers a pre-college Wall Street in the Classroom for high school students looking to learn the ins and outs of investment over their summer vacations. Offered through the Gabelli School of Business, in this program, students will learn the foundational principles of market economies, investment institutions, and financial portfolios. This course aims to teach students the basic theories and ideas they need to succeed in college-level economics and business courses, and it mirrors the models of instruction that you will receive in those courses. Students will learn from experienced instructors who will guide students through a week’s lessons on investment strategies and risk management practices.

Students enrolled in this class will also benefit from attending guest lectures and meeting directly with employees at NYC investment firms. These meetings will provide students with a practical understanding of how investment theories are implemented in the context of multimillion-dollar investment projects. Students will also learn about the basics of alternative investment strategies (including things like real estate and bonds), and they will receive an introduction to the philosophical field of business ethics. This program is an ideal broad-stroke introduction to the complex world of professional financial management and a great choice for students interested in pursuing an education in economics or business.

The University of California Los Angeles offers a pre-college Introduction to Investment course for students interested in learning a broad overview of the various career and training paths available to students hoping to find work in the financial industry. This course is open to students between 9th and 12th grade, and aims to give students a foundational grounding in all the major elements of investment and market economics. This course will help students understand how investment markets work, how they can participate in those markets and why it is important to understand how they impact our daily lives. Owing to its breadth, this course is a good fit for students interested in learning to manage their personal investment portfolios or those looking to major in business or economics.

This course covers micro and macroeconomic theories and issues, so students will learn a wide range of concepts, from personal finance and investing to market histories and the powers of the Federal Reserve. This makes the course a good introduction to economic theories and principles, and it makes the course useful for students with various long-term goals. Students will also learn how global markets are interconnected and how smart investment and financial decision-making account for the history, theories, and politics of global banking. Students enrolled in this course will be required to live on the UCLA campus over the duration of the course.